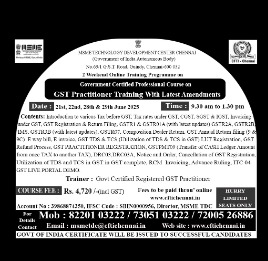

GST Practitioner Training With Latest Amendments

-

4,720.009:30 AM - 1:30 PMHurry up Limited Seats only

Coverage

- Introduction to Various Tax before GST

- Tax Rates under GST

- Invoicing Under GST

- GST Return Filing

- GSTR1 (With Latest update)

- GST Registration

- CGST, SGST & IGST

- GSTR2B, GSTR3B (With Latest update)

- GSTR07

- Composition Dealer Return

- GST Annual Return Filling (9 and 9C)

- E-Way Bill, e-invoice GST TDS, GST TCS

- LUT Registrations

- GST Refund Process

- GST PMT 09 (Transfer of Cash Ledger amount from Once tax to Another Tax)

- GST Practitioner Registration

- Debit Note and Credit Note Process in GST

- DRC03, DRC03A, Notice and Order

- Cancellation of GST Registration

- Utilization of TDS and TCS in GST in GST Complete

- ITC 04 Complete GST Live Portal Demo.

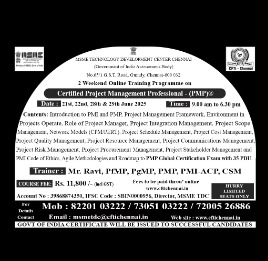

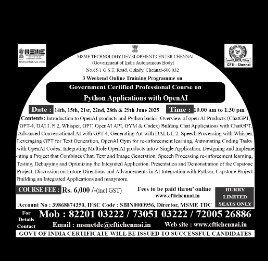

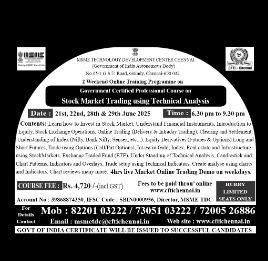

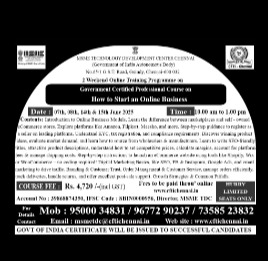

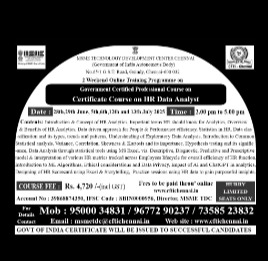

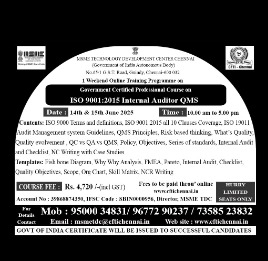

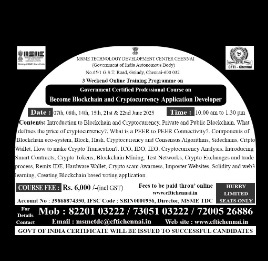

2 Weekend Online Training Programme On

Upcoming Specialised Courses

- Hurry up Limited Seats only

- 09:00 AM - 06:30 PM

11,800.00

- Hurry up Limited Seats only

- 06:30 PM - 09:30 PM

4,720.00

- Hurry up Limited Seats only

- 10:00 AM - 01:30 PM

6,000.00

- Hurry up Limited Seats only

- 09:30 AM - 01:30 PM

4,720.00