TDS RETURN FILING WORKSHOP WITH LATEST AMENDMENTS

-

2,500.009:30 AM - 5:30 PMHurry Limited Seats Available

Coverage

- Tax Deduction at Source Overview

- Learn when should TDS be deducted and by whom?

- Due dates and deadlines for depositing the TDS to the Government

- How to deposit TDS amount?

- How and when to file TDS return has to be Filed?

- What is a TDS Certificate?

- TDS Credits in form 26AS

- Tax liability in a case where TDS is already deducted from income

- SMS Alerts for higher transparency

- Registration on TRACES

- Filing of Form 24Q and 26Q

- Defaults – reasons, consequences and rectifications

- TRACES – Online correction process – Live TDS Demo

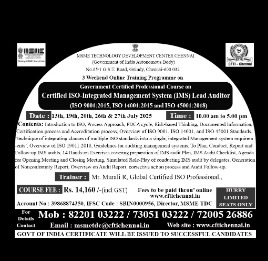

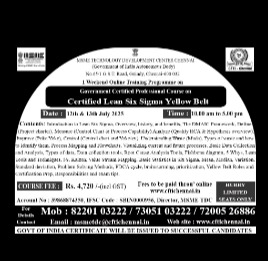

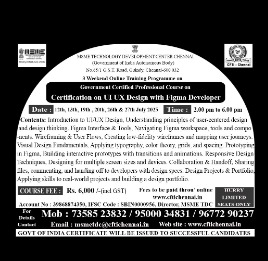

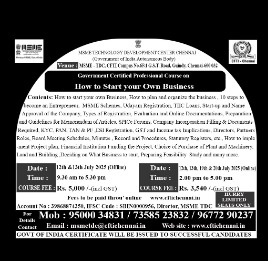

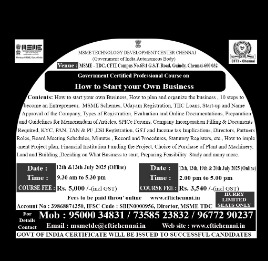

1 Day Offline Training Programme On

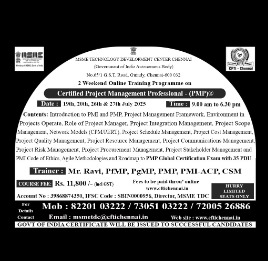

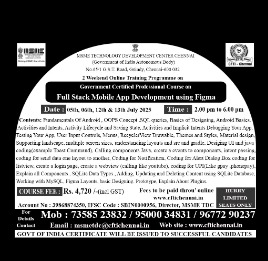

Upcoming Specialised Courses

- Hurry Limited Seats Only

- 10:00 AM - 05:00 PM

14,160.00

- Hurry Limited Seats Only

- 02:00 PM - 06:00 PM

6,000.00

- Hurry Limited Seats Only

- 09:00 AM - 06:30 PM

11,800.00